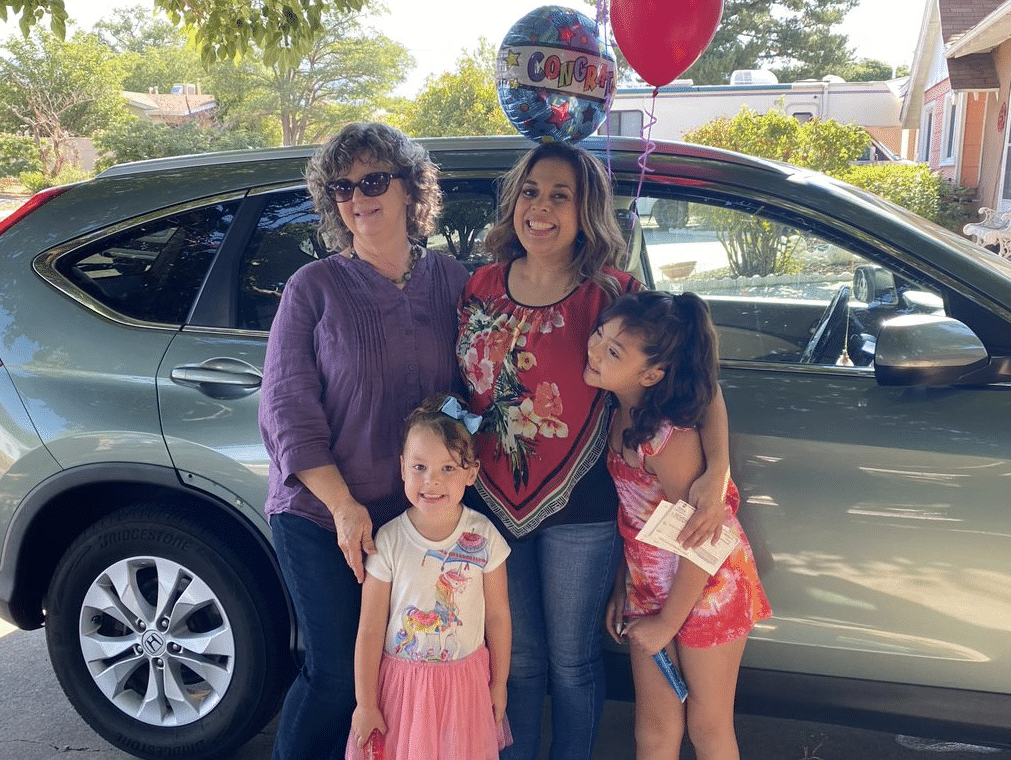

As a 2-generation program, our goal is for families to learn how to budget and build enough savings and assets to achieve financial security and freedom. Through a partnership with Rio Grande Credit Union (RGCU) and Prosperity Works, members of our alumni program can establish savings accounts for themselves and their children with an amazing 4:1 matching contribution.

RGCU is the hub of this program, managing families’ individual development accounts and providing financial empowerment classes. We sat down with one of the instructors for this program – Bryan Avalos, RGCU Community Relationship Officer – to hear more about this partnership and its importance to Saranam families.

Rio Grande Credit Union (RGCU) and Saranam’s partnership was established to help families increase their financial knowledge, provide financial empowerment classes to create long-term change, and guide families to develop the necessary skills to a lead a financially successful life.

We (RGCU & Saranam) have developed an effective series of classes to help families reach their financial goals, with topics such as budgeting, savings, credit, and building of wealth. Our classes include collaborative activities and discussions of personal beliefs, experiences, and knowledge shared both by the instructors and participants.

By learning different approaches, families can establish savings goals and personal budgets that meet their specific financial circumstances. These foundational skills allow individuals to objectively track their spending habits and hold themselves accountable, which is essential for meeting financial goals.

Having a strong understanding of spending habits and spending capacity will help hold participants accountable and meet their financial goals.

Some key takeaways we hope families leave with include:

- Establishing strong financial habits takes time and patience. Budgets will evolve throughout one’s life to account for new responsibilities, income changes, and lifestyle adjustments.

- Each household budget is unique, driven by personal financial goals and values.

- Creating a habit of saving is crucial, and families should prioritize paying themselves first by adding to a savings account (even if it’s just a small amount).

Teaching at Saranam has been an inspiring experience. We have witnessed determination, resilience, and caring for one another by these families. Despite challenges, they continue to work towards their goals, both financial and personal.

Our hope is that these families will continue to persevere through future obstacles and move forward with their aspirations.

Know that there is a strong support system that you can rely on within Saranam and Rio Grande Credit Union. Our biggest hope is to see you succeed and be able to support you in your journey.

Bryan Avalos – Rio Grande CU Community Relationship Officer